2023 Halfway Update on Venture Capital

Now that we’re halfway through the year, I thought I would give you a brief update on what’s going on in the world of venture capital, from recent sources in TechCrunch and the Wall Street Journal.

Why are major venture capital players scaling back their funds or shutting down certain funds?

WSJ reports that many of the major venture capital players out there are either scaling back the size of their venture funds, or shutting down certain funds. Famously, Softbank started its Vision Fund in 2017 which after it took profits from Alibaba, has been losing money the past few years and writing down losses.

Other venture capitalists are telling a similar story. The famous startup accelerator YCombinator eliminated its $3 billion growth investments arm called Continuity, which was meant to provide follow-on capital to its companies. The YCombinator Continuity fund had started in 2015, and invested $1.5 billion of that original $3 billion through the end of 2022. YCombinator closed that Continuity fund in the last few months.

Another famous venture capital firm Sequoia has downsized its business and says in perhaps the understatement of the century that a “few marginal investments snuck in” over the past few years.

You think?

What are the statistics provided by TechCrunch on the state of venture capital in North America?

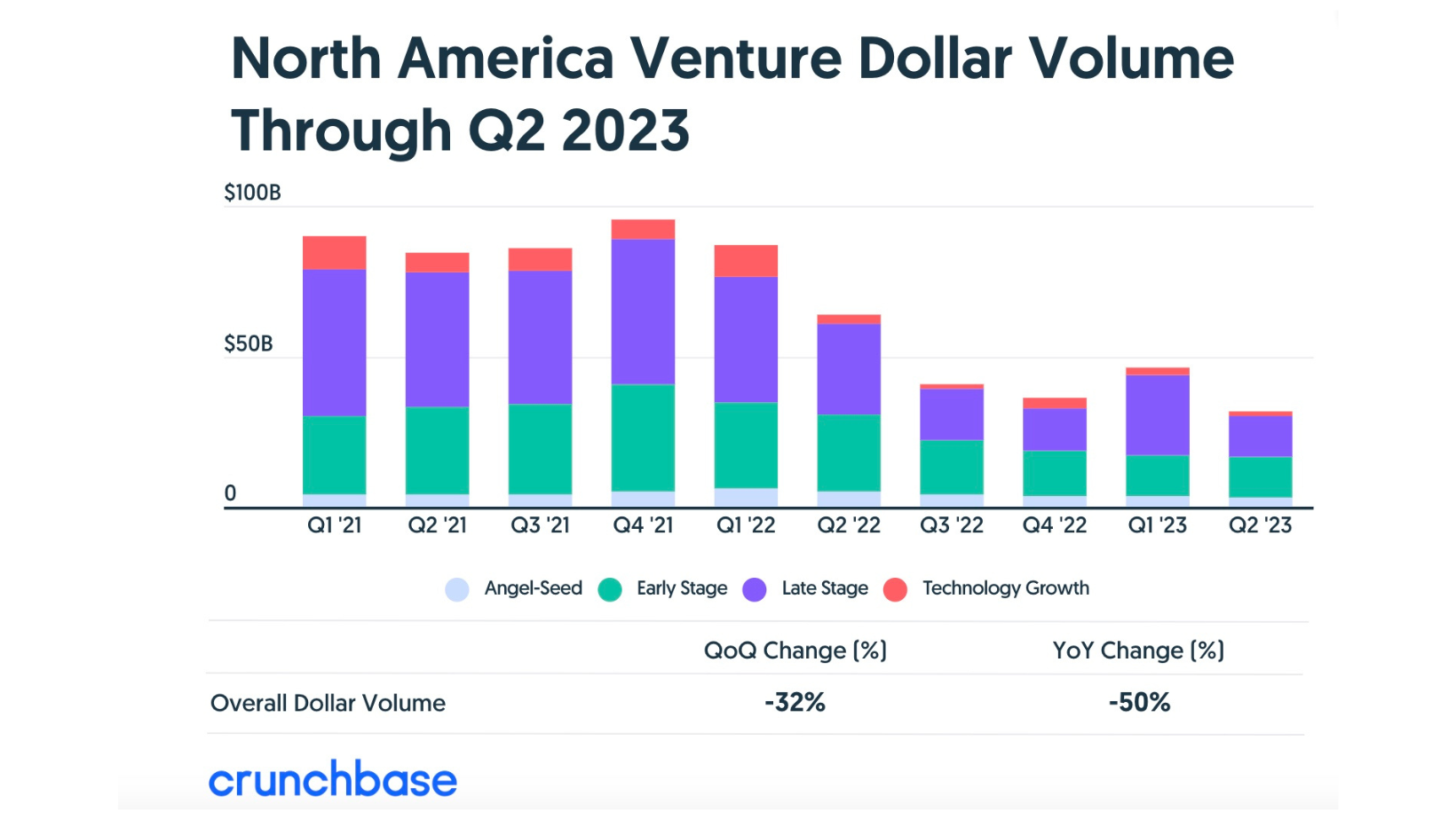

TechCrunch also provides some interesting statistics on the state of venture capital stating the North American startup funding fell across all stages in Q2 of this year. The funding decline is not just in terms of dollars, fewer deals were getting done as well in the first half of the year. The most pronounced declines in funding are in Series C and later, which will likely have an effect of these firms looking for the public markets, especially as the economic outlook for a soft landing seems to be looking more positive in the last couple of months.

Seed and early-stage startups experienced smaller declines, which is generally good because seed investments have been up in the past few years. A modest decline isn’t so bad for early-stage firms.

How do the current investment levels compare to the peak of the pandemic in Q4 2021?

Overall, if you look at investments in the last quarter compared to the peak of the pandemic Q4 2021, they are about one-third of their previous amounts.

Ironically, these numbers are somewhat good news for the market. Everyone is now convinced Fed Chairman Jay Powell now knows what he’s doing with the economy after calling him an idiot the past 12 months, and the economic outlook looks incrementally better in the next 6 months than it has in the last 6 months. Combined with the fact that early-stage investments look pretty robust, and more eCommerce IPOs will happen in the next 12 months, things could turn rosy pretty quickly.

What are the implications for venture capital investors in the second half of the year?

If you were on the sidelines in the year's first half, I would not have that same hesitation in the second half. While we aren’t back to boom times, I think the appropriate analogy is that it is time for the turtle to start peeking its head out of its shell.

Expert Consulting: How Will You Grow Your eCommerce Company?

When growth is elusive, I am an expert at asking incisive questions to surface the real issues and then present straightforward ideas that your team can actually implement.

Mistakes are expensive. They cost money, of course. What’s worse is the opportunity cost. I work with investors and management teams worldwide to help them get a handle on their digital business plans to execute a clear path forward.

For more on 2023 Updates, you might also like: