Foot Locker: Making Big Changes But Still Could Be in Trouble

What actions is Foot Locker taking in 2023 to reset itself?

Nike and FootLocker has revitalized their partnership and Nike merchandise should start appearing again in Footlocker stores around Christmas. Footlocker is closing the Lady Footlocker, Footaction and Eastbay brands in North America.

Four things are going on here:

Nike and FootLocker have revitalized their partnership and Nike merchandise should start appearing again in Footlocker stores around Christmas.

Footlocker is closing the Lady Footlocker, Foot Action and Eastbay brands in North America.

Foot Locker is closing 400 stores in class C and D malls.

The company is focused on developing a store of the future concept which will launch in New York City in 2024.

Which brands is Foot Locker closing in North America and Why?

First, it wasn't even obvious to me that Lady Foot Locker and Foot Action were still viable brands in North America to begin with. What were they doing still around?

As far as the lower-end malls are concerned, same thing. It's like their executives woke up from their slumber during the last 15 years and said: "crap, indoor-only malls with no declining anchors doesn't seem like a great business model anymore."

What is the store of the future concept that Foot Locker is launching?

Next, Foot Locker has announced that it will launch its “store of the future” in New York City?

OK, maybe this is just a terminology thing. When I think about store of the future, I think about a prototype that can be applied to the rest of America. Perhaps what they mean is brand flagship store? That is usually the type of store that comes to New York City.

Why Nike Should Align with Consumer Behaviors and Preferences

Also, is it clear now that Nike's push into DTC was slightly overdone? This is a brand lesson: you can't escape where consumers go!

If even a company like Apple is in a retailer like Target, Nike should be anywhere people shop for running or sporting goods -- as long as it remotely matches their brand positioning.

How Will Foot Locker Fare Against Competitors Moving Forward?

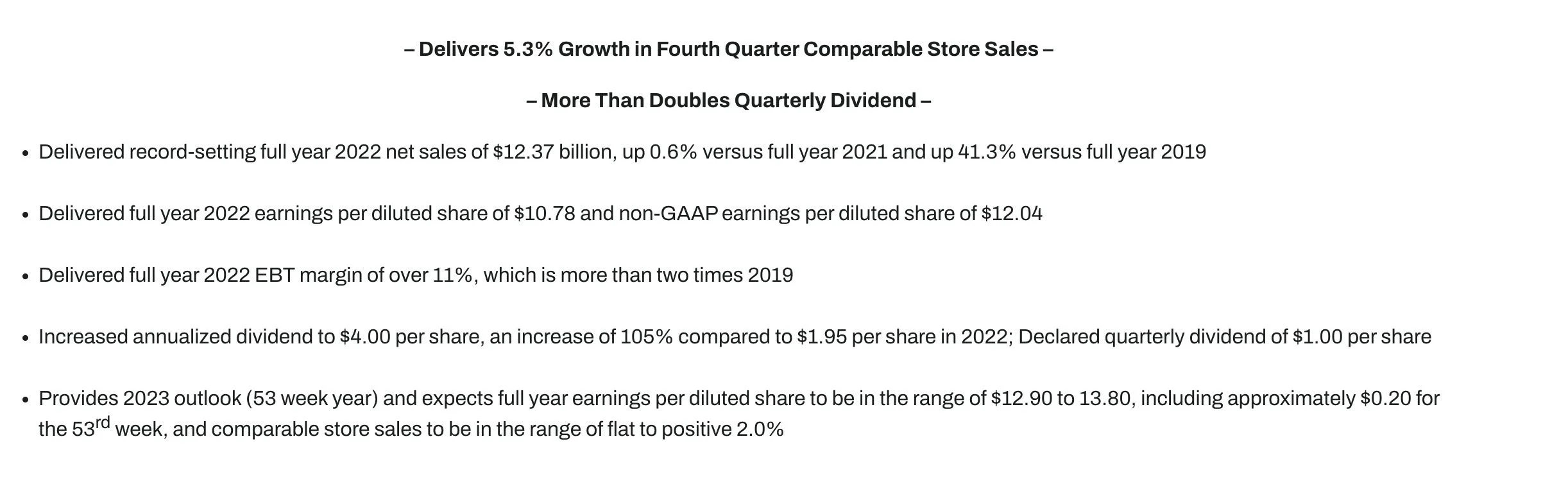

In the long-term, I worry a little about Footlocker and think it could get more pressure from players like Dick’s Sporting Goods in particular – they seem like a better-run company. Here are a few highlights from the last Dick’s Sporting Goods earnings report, which I will let you judge for yourself.

Dick’s Sporting Goods 2022 Earnings Report

Expert Consulting: How Will You Grow Your eCommerce Company?

When growth is elusive, I am an expert at asking incisive questions to surface the real issues and then present straightforward ideas that your team can actually implement.

Mistakes are expensive. They cost money, of course. What’s worse is the opportunity cost. I work with investors and management teams worldwide to help them get a handle on their digital business plans to execute a clear path forward.