Shopify Summer Editions Continues Focus on Entrepreneurship

This morning, Shopify published its bi-annual marketing release called Shopify Editions, which represents a few new announcements as well as a recap of the major updates in the past 6 months. A few surprises are lurking in here.

Which direction is currently winning for Shopify, and what are the three major directions they've framed their future around?

Earlier this year, I framed Shopify’s future in terms of 3 major directions.

Shopify, the Entrepreneurship Company

Shopify, the Payments and Services Company

Shopify, the Enterprise Software Company

Right now, direction 1 - Enterpreneurship - is winning, and second place is still far away. This release only reinforces that focus.

What are the primary areas of focus in Shopify's recent release?

Entrepreneurs

Platform

Longer-term bets

Entrepreneurs

How is Shopify using AI to support entrepreneurs?

While AI is the big news here, increasingly, Shopify views itself as a hub for all retail entrepreneurial activities. These features include:

I've written about Shopify Magic and Sidekick previously. Ultimately, AI is a double-edged sword. Shopify views AI as a critical enabling technology. These are designed to make the life of the Shopify merchant faster and easier. How much? Well, the jury is still out. Notably absent from much of the discussion about AI are metrics about its efficacy in revenue improvement or cost reduction.

On one hand, the worst-case scenario for Shopify merchants is that these changes end up being a way for Shopify to lower its costs to serve customers by reducing its support and service teams.

I’ve read a report that a SaaS company in India has already replaced 90% of its support teams with generative AI chatbots. It's just beginning, folks, and it's a copycat world. (Those who don't feel that Shopify's management is influenced by what Twitter, Meta, and Google are doing are kidding themselves - even Sam Altman is talking about this topic).

Let's be clear: exactly zero Shopify merchants would look forward to hearing that the company's support and service coverage might trend downwards due to AI.

On the other hand, if generative AI is going to be a way for companies to improve their businesses faster, and Shopify is ahead of this curve, then merchants themselves could benefit.

Ultimately, it's still early innings.

What is Marketplace Connect, and what marketplaces does it integrate with?

In addition to AI, another big splash in this release is what Shopify calls Marketplace Connect. This one surprised me, especially given Shopify's contentious history with Amazon. The feature allows merchants to integrate their products into marketplaces like Amazon, Walmart, eBay, and Etsy.

Under the covers, it definitely appears that Shopify didn't develop this themselves. If you read the Marketplace Connect page, it is powered by Codisto. Codisto is a third-party developer who had previously developed a connector between Shopify and Amazon.

But that's not all. There appears to be some kind of transition happening here, and a set of FAQs that this observer could easily interpret as an acquisition. The same seems to be indicated by Codisto's website. What's more, Marketplace Connect is now also present on Shopify's pricing page.

I put this in the section for entrepreneurs because there have been ways to connect to Amazon for the past 20 years — if you are a medium to larger merchant, you have options. This officially supported app (powered by Codisto) makes it a little bit easier.

Historically, most providers vastly underestimate what it takes to integrate with Amazon. I often find these kinds of apps provided by platforms and even the marketplaces themselves useful for only the smallest businesses.

Most growing merchants need something more dedicated; is Codisto able to keep up with larger industry players? That remains to be seen.

Lastly, while Shopify has cooperated with Facebook, Google, Tiktok, and others over its history, its relationship with Amazon has always been love-hate. This makes it clear that the Rebel Alliance and the Empire have officially recognized each other's diplomatic status and have exchanged ambassadors.

How might Shopify Credit be a source of revenue for the company?

Another update that could be another source of revenue for Shopify is Shopify Credit. This is a business charge card that helps users organize expenses. Since Stripe released their Charge Card program for its Stripe Issuing product, it was only a matter of time before this came to Shopify. We talked about this about a month or so ago on the podcast. But again, this is more of a product for entrepreneurs and replaces functionality they could get with Intuit Quickbooks. I would continue to watch this space here because all Shopify needs to do is develop or acquire an accounting package to be an all-in-one competitor to Intuit.

Regarding the narrative I used to open this post, this item could be put in the "payments and financial services" bucket. That said, it's clear that with regards to Shopify's focus, its financial services products are in service of retail entrepreneurs.

Platform

Regarding the core platform, there are a few things to discuss. My favorite first: Bundles.

What are the new features in the Shopify platform, and how does Bundles enhance sales potential?

Bundles is one of my favorite new features and it allows you to group multiple SKUs or quantities of SKUs into a fixed bundle or a multipack.

People might wonder why bundles are essential -- let me tell you why. The core of any merchant's business is inventory. Suppose merchants need to create new SKUs and assign inventory to them; that limits their sales potential because those products may not be available to commit elsewhere. However, if a merchant or a consumer can create bundles from SKUs and variants, then the sales potential is increased. The implications of this feature extend throughout the entire platform because it is a foundational capability.

Bundles can also make it easier for customers to shop at an unfamiliar store by creating purchase options at different stages of a buyer's adoption journey.

How is Shopify catering to the B2B market?

There are B2B features in this release, but to me there are a few types of B2B companies. There are direct-to-consumer businesses that are trying to establish a B2B channel. Then there are manufacturers and distributors who are trying to use digital tools to become easier to do business with, lower their costs, and grow their sales. Private equity has especially been active in the B2B market over the past few years working to transform old-school businesses into digital ones.

Shopify’s new B2B features (volume pricing, quick order lists, quoting enabled by draft orders, among others) still seem centered around a Direct to Consumer-oriented business that wants to add a new channel. The pace of B2B innovation and flexibility does not yet match its competition -- all of whom have a head start on the company.

How Does Checkout Extensions Empower Customization for Shopify's Enterprise Strategy?

The other significant feature in this release is Checkout Extensions which has reached general availability. Extensions are the way in the future for all merchants and developers to customize the Shopify checkout, now that checkout.liquid is being deprecated.

I won't belabor this one, but it's hard to overstate its importance in Shopify's Enterprise direction (other than some foundational platform elements mentioned here, did not get much press in this release). Checkout and Payments is the heart of Shopify's Enterprise strategy, so this kind of customizability is table stakes to the firm.

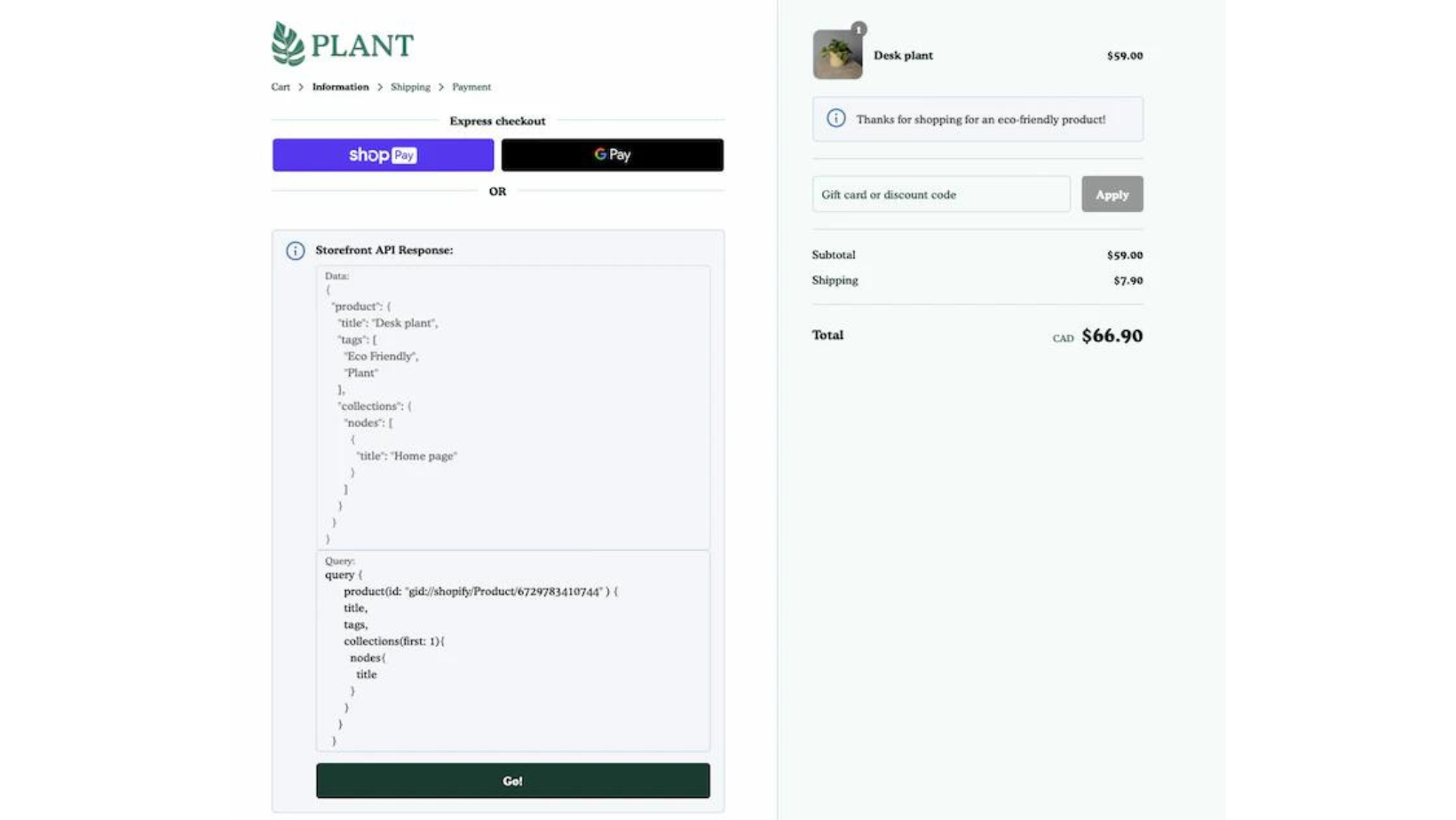

What are the improvements to the APIs and Admin Portal called?

Lastly, Shopify released some API improvements and updates to its Admin portal (which they call Polaris).

Longer-Term Bets

What are the updates to the Shop App, and what potential impact might it have for merchants?

Shopify also released some updates to the stores within Shop App to make it easier for merchants to engage with customers. The jury is still out on Shop App; I just don’t see this being a material channel soon for the average merchant compared to social media (hello TikTok Shop), Amazon, or their Shopify store. For smaller merchants, I mean, why not be there? But, what about larger merchants? Those merchants would be better off with their own app, not within the 4 walls of Shop App.

I'm still trying to figure out what's truly happening here. Each month I feel like I could just as easily wake up and see "Shopify ends Shop App experiment" as "Shopify doubles down on Shop App." We are undoubtedly in the messy middle of their investment plans with Shop App.

Wrapping Up: What does this edition clarify about Shopify's priorities and future direction?

This Edition clarifies that despite payments and enterprise software being new initiatives for Shopify, home is where the heart is. And the heart of Shopify is with entrepreneurs. That’s not to say its financial solutions aren’t important (you might even say they are the entire business model), but they will never be quite as crucial as entrepreneurs are to the firm.

Even the casual observer can't help but notice the sheer volume of features being released. But therein lies the tension. Shopify is about simplicity. Yet, a relentless pace of new features brings complexity of organization, maintenance, not to mention merchant and partner adoption. Managing this type of complexity takes much more than the crafter-centric historical focus of Shopify. Being able to channel that complexity into something easy to adopt will remain an area to watch going forward.

Expert Consulting: How Will You Grow Your eCommerce Company?

When growth is elusive, I am an expert at asking incisive questions to surface the real issues and then present straightforward ideas that your team can actually implement.

Mistakes are expensive. They cost money, of course. What’s worse is the opportunity cost. I work with investors and management teams worldwide to help them get a handle on their digital business plans to execute a clear path forward.

For more on Shopify, you might also like: