Shopify’s Strategy in 2023: Solid Core, Attaching To A New Future

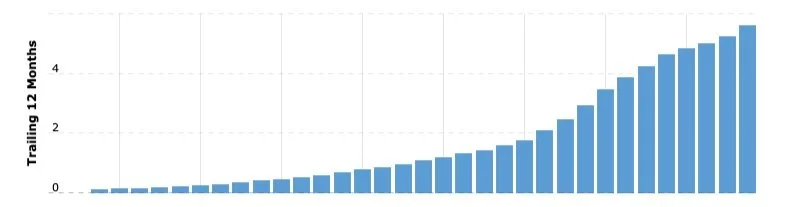

As one of the most successful e-commerce platforms, Shopify has experienced tremendous growth over its history. Shopify’s runup prior to the pandemic and especially during it has been one of the great eCommerce software success stories.

Shopify Revenue, Trailing 12 Months, 2014 - 2023, Source: MacroTrends

What Has Shopify Done Well Since Its Founding?

The company has combined a few major themes to power its growth:

Focused on a singular vision from a strong opinionated founder in Tobi Lutke.

Cultivated a strong product and engineering culture.

Relied on “product-led growth” encouraging the product to speak for itself rather than spend on expensive marketing campaigns.

Successfully moved from a business model based on monthly subscriptions to one based more on GMV coinciding with the introduction of Shop Pay’s penetration of Shopify GMV, and the rise of Shopify Plus.

56% of Shopify payments volume is provided by Shop Pay (2022 FY Financials).

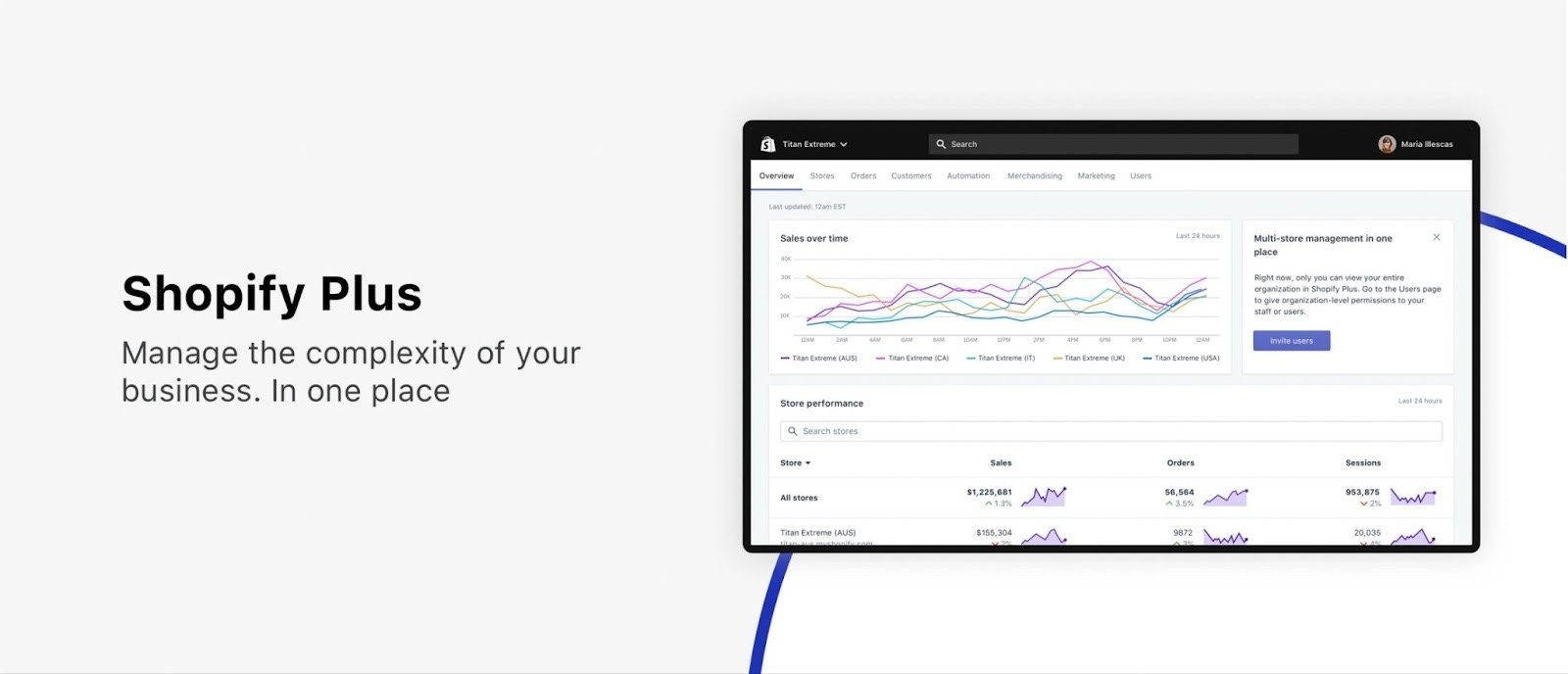

Moved up-market from its original entrepreneurial roots with the successful penetration of Shopify Plus, which now captures over 50% of its GMV (2022 FY Financials).

Became almost synonymous with Direct-to-Consumer eCommerce, particularly in the entrepreneur and SMB segments, with ambitions higher than this.

While Shopify has accomplished a great deal since its founding in 2006, outside of its core Shopify Plus offering, the road ahead is not entirely clear. The industry has gotten more competitive, and Shopify is pushing well outside of its traditional DTC SMB boundaries. As a result, Shopify faces new challenges and opportunities. This article explores Shopify’s current state, its ambitions and innovations, and the challenges it must overcome to maintain its leadership position in 2023.

Shopify has a tremendous history and provides a fantastic product for upper SMB and lower-mid-market merchants. It’s virtually synonymous with Direct-to-Consumer eCommerce, and I personally recommend it to most companies that I meet and consult with.

But what fun is it to write about things as they are? I write about what I find most interesting, and that is generally “what could be.” What could be at Shopify is also great.

But it is not a given. In some cases, I have advice and prescriptions for Shopify.

What are the Challenges Facing Shopify?

Shopify’s road ahead depends on a few elements:

Pivoting successfully from a DTC-focused message to an omnichannel message

Firmly planting its flag in the middle-market and Enterprise space to accelerate GMV growth

Clearly articulating and executing on its Shop App “Marketplace”

Staving off challenges from headless eCommerce vendors looking to take its Shopify Plus customers, and Amazon’s New Buy With Prime offering looking to steal its payments and fulfillment business at the low-end

Rounding out its management team with a Chief Marketing Officer , and despite the Allan Leinwand experience (who left Shopify), another Chief Technology Officer

The need to find a high-margin business that provides a growth flywheel for the next phase of business maturity

Of all these challenges, the lack of a Chief Marketing Officer is probably the largest gap the company is facing because messaging and awareness are critical to several of the challenges above. In fact, Shopify’s other strengths such as accelerated feature development actually exacerbate the problem.

In my own experience, once a company reaches a certain size, one of the bigger problems it faces is “over-development”, meaning that the product gets too feature-rich for the market it is serving. As Shopify gets more complex, SMB customers can’t pay for the additional costs of development. Who needs more features? Enterprise customers. Except Shopify has yet to fully lean into Enterprise messaging.

Not only does this make the company more susceptible to low-end disruption, but it also becomes more likely that customers say “I didn’t know it did this,” which negates the value of all that feature development.

Brand extension is one of the most challenging elements of building a business. And, make no mistake, Shopify is currently overestimating its ability to penetrate the Enterprise market segment because it overvalues speed of technological development as a go-to-market strategy. The best organizations, like Apple, balance great technology with great marketing. It’s not a slight to Shopify to judge that Shopify still has more to learn here. Shopify will regret not getting extra marketing firepower sooner, and each year that passes it becomes less likely it will be able to break out of Shopify’s “SMB perception” in that segment.

But enough about these future challenges, let’s talk about Shopify today.

What is the Current State of Shopify?

Shopify currently powers millions of businesses worldwide, in over 175 countries, with more than 2.1 million daily active users. Shopify has become a dominant player in the eCommerce space with an estimated market share of 10.3% in the US and a revenue growth rate of 60% YoY (Source: Kinsta). The pandemic has only accelerated the shift to eCommerce, and Shopify has played a vital role in helping small and medium-sized businesses (SMBs) transition to online sales.

Since the launch of Shopify Plus in 2014, Shopify set itself on a different path. At the time, I suspect even the company itself did not know where it would lead. The key was when the company added Shop Pay to its Plus offering, charging 0.25% of GMV, or $2,000 per month. As Shopify Plus has grown to over 50% of the company’s GMV, based on the company’s 2022 FY earnings call, Shop Pay has become Shopify’s engine of growth. eCommerce software is almost an afterthought.

As a result of this change in Shopify’s monetization strategy, the company has largely become a financial and payments (fintech) business that happens to have an eCommerce platform, rather than the other way around.

How Has Shopify Strengthened Its Core?

In the past 12 months, Shopify continued to make strategic improvements to improve its business. This section highlights a few examples of Shopify’s recent efforts to improve the business.

Engineering Refocus and Productivity Improvements

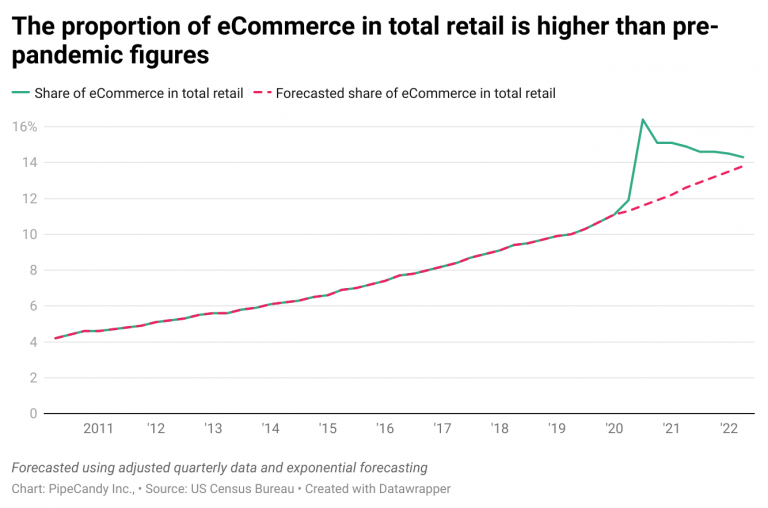

Of course, the pandemic changed a lot of things. The end of the pandemic changed even more as it became clear that Shopify became slightly unfocused, bloated, and overstaffed. eCommerce is now back to its pre-pandemic growth trajectory.

One of the most notable changes that Shopify made in 2022 was the departure of its CTO, Allan Leinwand; the departure of two of his top vice presidents; and the subsequent reorganization of its engineering department. These plus other changes had the following goals:

Elevate the craft of coding at Shopify above “management,” which is increasingly viewed at Shopify as “overhead”

Remove distractions from valuable development assets by canceling many meetings across the organization and streamlining processes

Improve the throughput of product and feature releases to the core platform

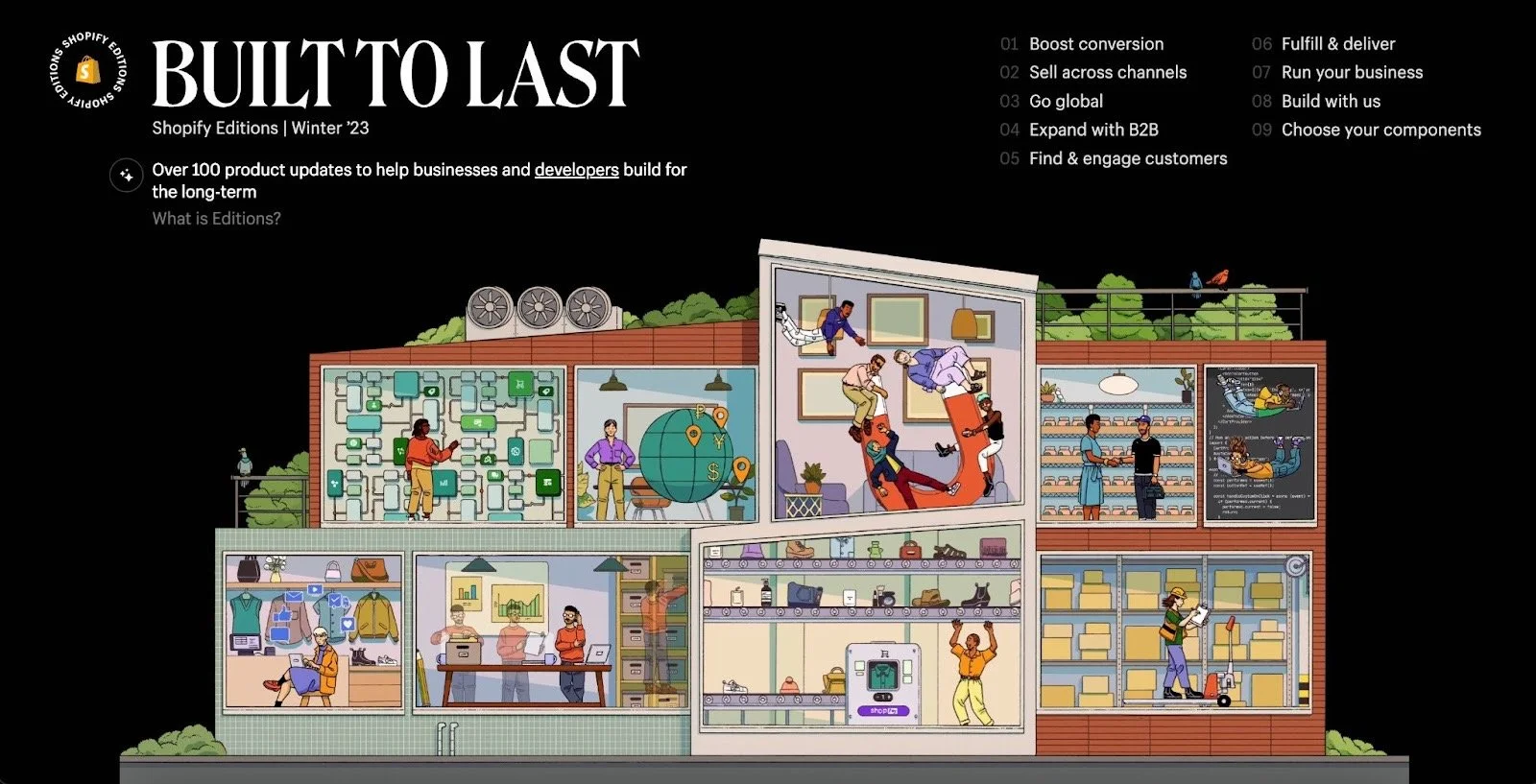

The results of these changes can be seen in the company’s early 2023 Shopify Editions product release update, one of the largest in Shopify’s history.

Shopify Editions

The goal of Shopify Editions is marketing: showcase Shopify’s work to the eCommerce world every six months. These new editions are designed to help businesses of all sizes grow and thrive on the platform. They come with a range of new features and integrations, including tools for inventory management, customer engagement, and marketing automation.

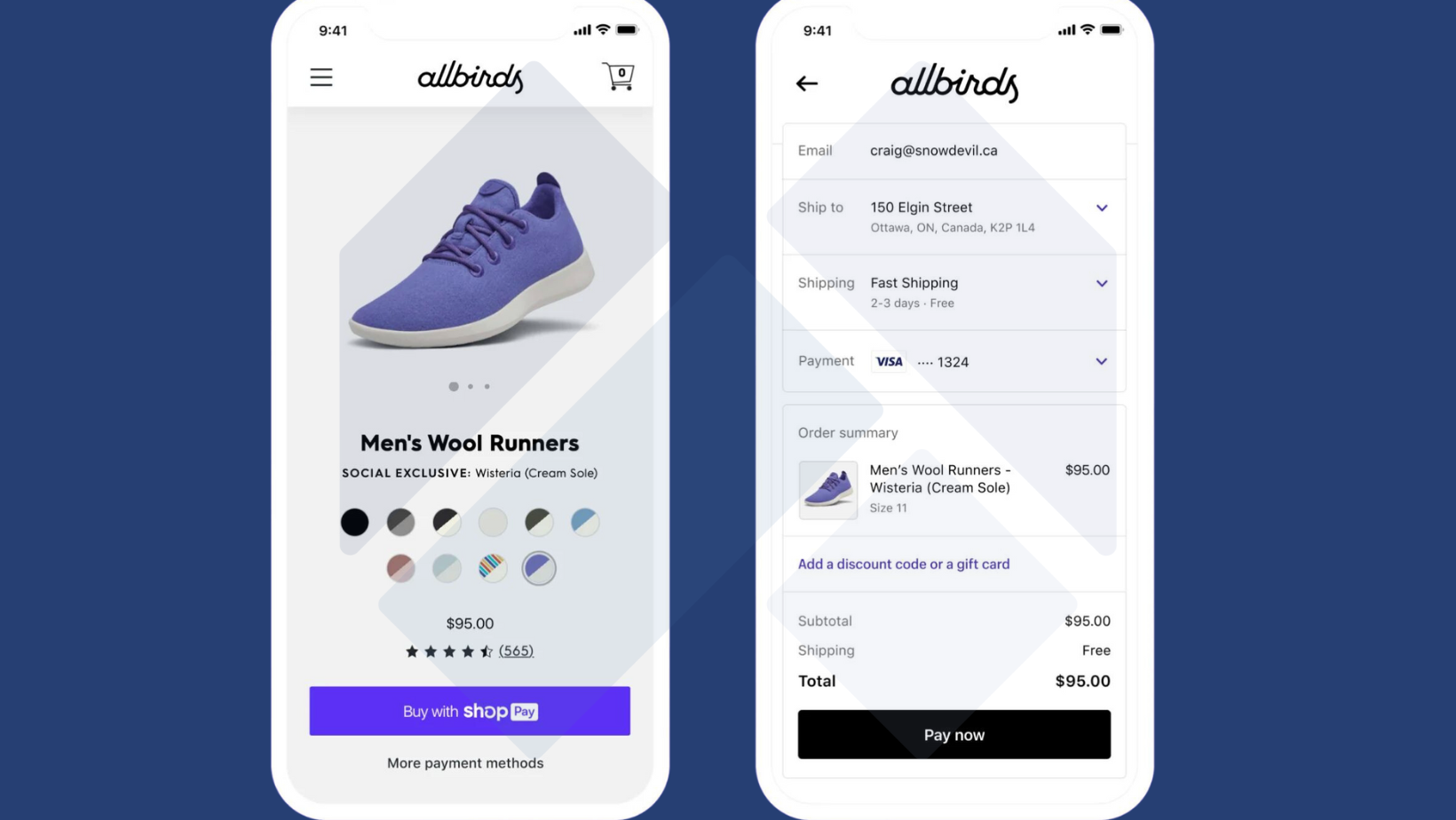

In the last Editions release, Checkout was the primary focus. The company has been on a path to release a new “Checkout One” experience such as faster loading times and customizable checkout fields and workflows. Shopify will also deprecate its legacy checkout customization approach (checkout.liquid) soon.

Price Increase On Lower Tiers

In an effort to increase revenue, Shopify recently raised prices on some of its lower-tier plans. At the same time, it shortened the length of its trial period,meaning people need to pay up sooner. Given the relative lack of importance of subscription revenue to the company, these impacts will be minimal except in one area: it should quiet some of the Wall Street chatter about churn. After all, lower tiers contain more churn because retail is a difficult business. Some analysts have even called Shopify a “Churn Factory.” Raising the prices of these tiers should discourage just anyone from signing up for Shopify, which should have the desired impact of reducing the company’s churn.

Shopify had not raised prices in its history and was long overdue for this type of change. At this point, all eyes are now focused on what changes Shopify will make to its mainstream Plus pricing. President Harley Finkelstein has said that Shopify will raise the price of Plus from 0.25% at some point, but has not set a timeline. No doubt Shopify will keenly watch the growth of Plus, its ability to capture new sources of GMV, as well as the health of the overall economy, as a signal for the right time to raise Plus prices.

What Has Shopify's Omnichannel and POS Progress Been?

One of Shopify’s increasing priorities over the past few years has been its investment in offline sales channels, including a Point of Sales (POS) system.

Shopify has been expanding its offerings to include omnichannel and point-of-sale (POS) solutions for businesses of all sizes. In this space it has competition from vendors such as Square (Block), Lightspeed, and innumerable incumbents. POS is not new or cool – quite the opposite. In fact, the primary innovation in the low-end POS space in the past 15 years was completed by Square when it launched its iPhone dongle in 2010.

According to the company's recent Q4 2022 financial results, Shopify's POS is a fast-growing business, with increasing numbers of merchants using it to sell their products and services in-person. In Q4 2022, the gross merchandise volume (GMV) of transactions processed through Shopify's POS system grew by 104% YoY, indicating that the demand for in-person selling solutions continues to increase. These numbers are deceptive, however. The fact that Shopify has not broken out its POS revenue likely means that it is less than 10% of its total GMV.

To cater to this demand, Shopify recently raised its limit for the number of locations it supports to 1,000. This means that a business with a larger physical presence can now use Shopify POS to manage its operations across more locations, making it easier to track inventory, manage customer data, and process transactions in real-time. Additionally, Shopify POS now supports multi-location inventory, enabling businesses to manage their inventory across multiple locations from a single dashboard.

In what seems like another new message for Shopify, Finkelstein has stated that the company's goal is not just to power online eCommerce, but commerce anywhere it happens. Of course, it remains to be seen if D2C darling Shopify can successfully pivot its message into a market that, heretofore, it has not been targeting. Up-market, the POS market is highly commoditized and low-margin, and in the lower and mid-markets there are several established competitors such as Square, Clover, PredictSpring, among others.

Shopify will naturally have more success with companies where eCommerce is a greater portion of its business, as compared to retail. Square and others are more likely to have more success where retail is a lion’s share of the business.

What Happened With Fulfillment?

Of all Shopify’s bets in its history, Shopify’s fulfillment strategy has been one of the company’s most ambitious, controversial and, ultimately, misguided.

To review, the company acquired Six River Systems in 2019 for $450 million, and Deliverr in 2022 for $2.1 billion. Not to mention, it invested over $400 million in Flexport that same year.

If you’re not familiar, Six River Systems is a warehouse automation company thats goal is to improve warehouse productivity. While the company has software enabling companies to streamline its operations, the crown jewel of Six River Systems is the Chuck robots that can be installed inside warehouses to help workers improve picking speeds.

Deliverr, on the other hand, was born as a tech-enabled logistics company. The company built an asset-light set of software and services in order to help D2C brands flexibly expand their fulfillment capabilities without expensive capital investments. Deliverr partners with independent 3PLs around the country to to create a nationwide fulfillment capability. Deliverr originally became known as the first company to power Walmart’s 2-Day Shipping badge for its marketplace sellers.

With these acquisitions, Shopify aimed to streamline its fulfillment capabilities and offer a one-stop-shop for merchants looking to sell their products online. Industry observers and financial analysts are waiting to see the results of the initiatives, which have been slow to materialize.

Shop Promise as the Next Frontier

The closer that Shopify got to selling off Deliverr, the more it started talking about Shop Promise and the conversion enhancements of its shipping badge, and the less it talked about fulfillment excellence. To be clear, Shopify never intended to compete with Amazon in fulfillment.

Post-Deliverr divestiture, it’s worth considering the future of Shop Promise.

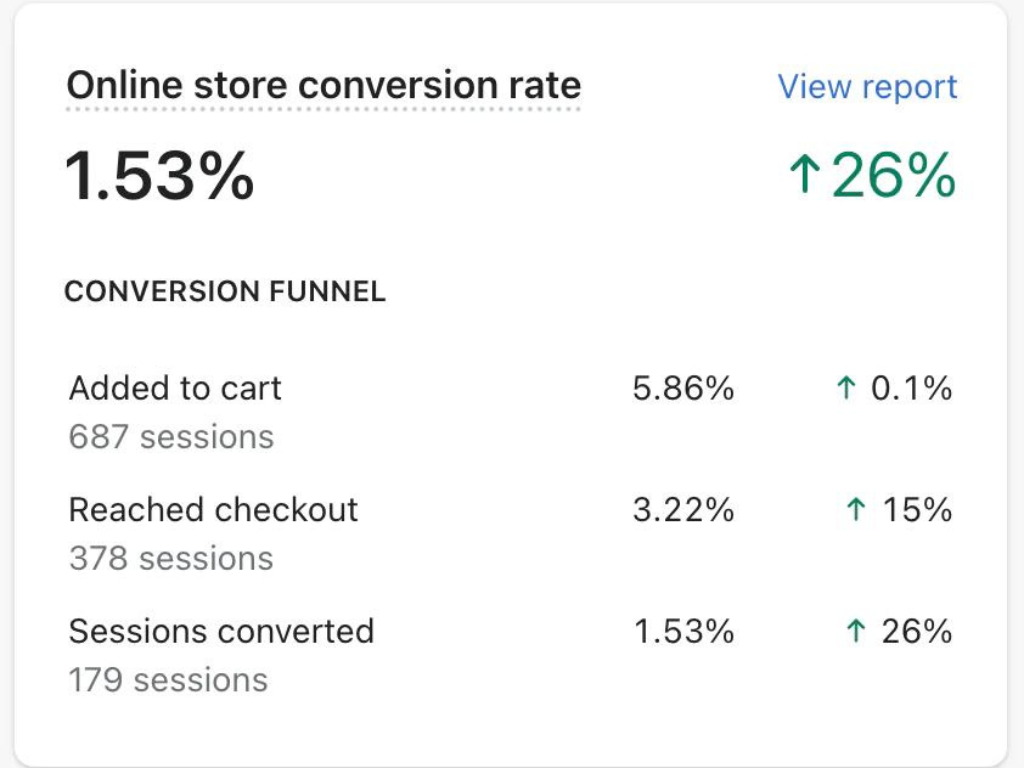

Shopify’s goal with Shop Promise is to raise conversion rates so that Shopify's GMV can grow faster. Shop Promise plans to accomplish accomplish this through the use of a badge on the product detail page of a merchant in order to promise a date-definite shipping experience to consumers. The thinking goes that if consumers have more confidence when they are going to receive their goods, they are more likely to order from a particular merchant. Indeed, Shopify has run tests on this claim and reports a 25% conversion rate lift. One only needs to multiply its 2022 $197 billion GMV by 25% to understand how Shopify views the addressable opportunity for this feature.

There are pluses and minuses to the Shop Promise idea. On one hand, I expect the badge will improve conversion rates somewhat. Consumers like delivery certainty and transparency. On the other hand, operations is key to eCommerce in the long-term. For this, Shopify must rely on partners to raise the level of shipping performance. This could be feasible with the right marketplace-based infrastructure, but I have yet to see any evidence that Shopify is executing on such an approach. In fact, signs point to the fact that after divesting Deliverr to Flexport, Flexport is now the preferred provider for fulfillment on Shopify. The fact that Deliverr has only been in business for a number of years in a highly competitive third-party logistics market tells you a lot about Shopify’s aims here: do the easy stuff (Shop Promise badge) and let others worry about the hard stuff.

Shopify and Fulfillment Were Never Going to Work

In surprise news as part of its Q1 2023 earnings call, Shopify sold off both Deliverr and 6 River Systems. In other good news for the market, it laid off 20% of its workforce.

I have spent a lot of time unpacking this transaction and what it means, in particular the valuation math of Deliverr and Flexport itself. While I encourage you to read the analysis, the TL;DR is that Flexport got the better end of this transaction — at least from a valuation point of view. Shopify still made the right decision to divest its logistics assets, however, and the company should definitely get credit for making what must have been an extremely difficult decision.

So in the end, both sides get something out of it. Flexport expands its total addressable market. Shopify removes a major distraction.

As you can probably tell, I have had a dim view of the success of Shopify in the fulfillment market. There are at least a few major reasons that it was never going to go well:

Customer type: Growing D2C brands often demand a high-level of customization, which is more expensive to provide for a logistics operator. For this reason, 3PLs often specialize around categories, which Shopify cannot afford to do.

Customer segment: 3PLs usually have volume minimums in order to make the work of onboarding a new merchant worth their time. The vast numbers of Shopify’s merchants are small and low volume. Even if this is a viable approach, Shopify as a company has not clarified that this is a solution aimed at the Plus market.

3PL partner profitability: Large numbers of demanding customers pushed to third-parties without appropriate offsets from Shopify is a recipe for disaster for the P&L of the average third-party logistics provider. Amazon can afford to offer fulfillment at a discount to smaller merchants because it is taking advantage of Amazon’s rate card — the best in the industry. A 25-year logistics veteran I’ve known for years once told me: “The best 3PL businesses would never want to join a 4PL.” The reason is, these companies are looking for high-volume merchants with particular criteria. The fundamentals of Shopify’s fulfillment business could degrade over time due to adverse selection of its logistics partners.

To be clear, a lot of these criticisms do not change regardless of who owns Deliverr. Flexport will not have better luck here, but at least it has supply chain professionals working there. So, that’s something.

What is Going On With Shop App?

Shopify’s Shop App has been another testing ground for the company. Originally launched as “Arrive” in 2017, the company sought to capitalize on the Direct-to-Consumer boom in 2020 by relaunching the app as Shop App.

Recently, Shopify has been working to improve the Shop App not only by the addition of Shop Cash, a new program designed to incent purchases on Shop App, but also through the introduction of Shop Minis, a way for merchants to customize their stores.

Shopify's Shop Minis: A Bazaar-Like Marketplace

Shopify's new Shop Minis feature is a new marketplace that allows merchants to showcase their products in a more interactive way. This feature enables developers to create unique in-app experiences that can be adopted by its merchants. The challenge is Shopify’s approach:

Let developers and merchants customize the app.

See what works.

Remake the app into something that works.

Publicize the app.

This program is taking a page from the playbooks of Chinese super-apps like Wechat and others and it’s too nascent to comment on it that much.

Where We Are Today: Pre-Product Market Fit Shop App

But what is Shop App? Is it part of a loyalty program? If so, why isn’t there a cross-brand loyalty program that brands can benefit from?

Shop Cash seems to benefit Shopify itself more than its brand partners, and appears to be a step in the direction of a unified marketplace.

Is it a marketplace? If so, why isn’t there something as simple as multi-brand checkout?

It’s almost an industry running joke at this point that Shop App is so obviously a marketplace that refuses to call itself one, and as a result will not succeed in this aim, either.

Three years on, Shop App has not gained product-market fit — primarily because the company refuses to admit what it is, and so the company must continue to tinker before it will produce material results.

In the end, the biggest criticism I can make of Shop App is that I have no idea what it is supposed to be, or how Shopify will efficiently acquire customers for it.

It’s not just me — Shopify has not clarified this either.

What Should Shopify Do About Buy With Prime?

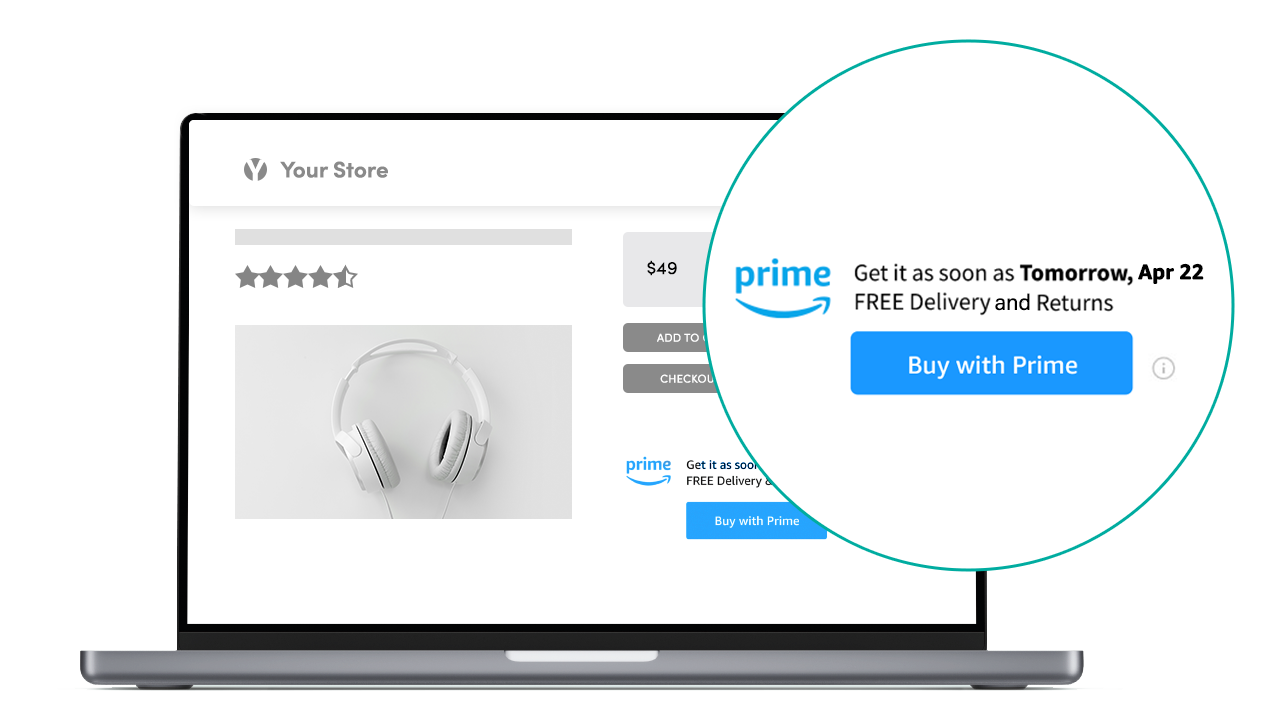

After years of picking fights with Amazon, Shopify finally got the attention of the giant when Amazon announced Buy With Prime in April of 2022, with a January 2023 official launch.

Luckily for Shopify, it’s still early days for Amazon. Of course, this is Amazon’s third attempt at an off-Amazon eCommerce store strategy — the previous two attempts having failed to produce any scalable results.

Finkelstein has said Shopify is having active discussions with Amazon about a deal. Based on the contours of previous answers to investors, I expect any deal to have these tenets for Shopify:

Ownership of customer data, with some rights to share with Amazon — not the other way around

All payment flowing through Shop Pay, with Amazon Pay as an anchor partner (You have to give something to get something.)

Shopify’s preferred fulfillment provider Flexport gaining “Seller-Fulfilled Prime” status within Amazon (To be honest, this is the top thing I can think of Shopify truly wanting from Amazon.)

Amazon maintaining a connector between Shopify and Amazon, integrated with Shopify’s App Store

Shopify is growing faster than Amazon, and, notwithstanding AWS, has a greater profitability potential than Amazon over time. As a result, time is on Shopify’s side.

Shopify initially attempted to slow the adoption of Buy With Prime on its platform due to the introduction of Javascript warnings during setup within Shopify’s console. This is a smart approach and designed to give Shopify both leverage and time to develop a proper strategy.

In my opinion, the risks of Shopify signing a harmful agreement with Amazon is much higher than Shopify doing nothing with Amazon’s Buy With Prime. While many industry observers state that Amazon has leverage, I feel the opposite is true. Shopify should be willing to wait until it gets all of its terms.

But what does Shopify gain from an alliance?

Amazon’s risk of failure with Buy With Prime is extremely high, having assigned a leader reporting directly to CEO of Amazon Stores, Doug Herrington. This is the same level of priority given to Amazon’s third-party marketplace, physical stores, etc. As a result, the failure optics for Amazon are much higher, and Shopify’s eCommerce leadership position make it a critical player to work with.

As most industry watchers will tell you, if you do a deal with Amazon, it will figure out how to win. Perhaps Shopify should listen to what Artificial Intelligence Joshua said about tic-tac-toe in the iconic ‘80s movie Wargames:

“Strange game. The only winning move is not to play.”

How Can Shopify Commerce Components Address the Middle-Market and Enterprise?

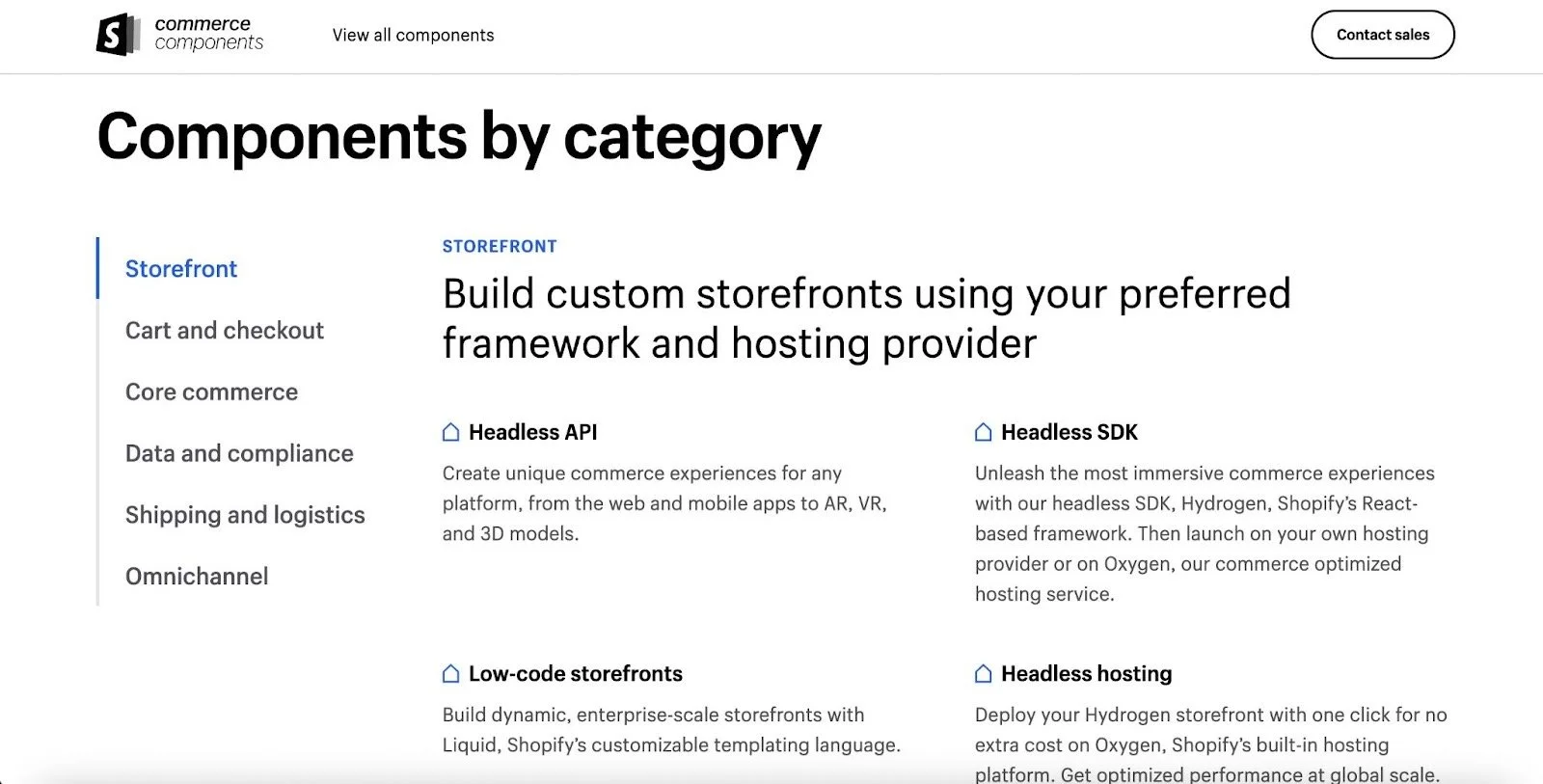

Shopify Commerce Components, a suite of tools and features offered by Shopify, is the company’s program to address the needs of middle-market and enterprise businesses. While Shopify has historically focused on serving entrepreneurs and small businesses, the company recognizes the need to expand into larger markets.

Shopify’s move into the enterprise market will see it competing with the likes of Salesforce, CommerceTools, SAP, Kibo, and others — depending on how you define the market.

Shopify’s biggest questions when moving up-market are as follows:

Can Shopify overcome its reputational baggage as software for entrepreneurs?

Can Shopify support an enterprise sales and marketing organization required to sell components with longer sales cycles?

How does the company continue to position Shopify Plus going forward?

Will Shopify’s move up-market dilute its SMB focus?

Can Shopify Overcome its Brand's Reputational Baggage as Software for Small Entrepreneurs?

Of all the risks to Shopify going after the Enterprise market, the biggest is the most difficult to address: the Shopify brand itself. But you don’t have to listen to me discuss the power of a brand. Steve Jobs used to famously speak about how difficult it is in a noisy marketplace to stand out. Buyers have many choices, and there are only a few words that one buyer might say to another in an elevator about a company, despite how many hundreds of features a vendor might have released last year.

“Marketing is about values. This is a very complicated and noisy world. We’re not going to get people to remember very much about us. No company is. And so we need to be really clear on what we want them to know about us.”

Every Enterprise buyer really just needs to know one thing: is this company focused on my needs above all?

Despite the promise of features and functions, the question that will keep a CEO up at night is: what platform can you stake your reputation on? Is that brand Shopify?

For that answer to be yes, it’s more than just the features and functions. It’s about the community of companies that a laggard CEO can trust: “Well, if Shopify solved it for <Fortune 50 company>, it’s good enough for me.”

So far, Shopify only has aspirations at the top of the market, despite its rhetoric. And even if it gets three to five companies in this bucket, can you trust that you will get the same attention amongst the millions of micro-brands that Shopify is used to serving?

Maybe. But are you willing to bet your career on that decision?

Can Shopify Support an Enterprise Sales and Marketing Motion?

You can forgive Lutke if he is skeptical of marketing. He’s a developer after all and leaves that PR funny-business to Finkelstein. The company seems to have a general dim view of marketers. Prior to 2019, there were times Shopify was doing traditional brand marketing (such as billboards and other approaches) — all of which Lutke killed. In the place of marketing, Lutke put in its place product-led marketing. Gone is marketing for its own sake. Instead, the company relies on word of mouth; the product alone should encourage users to refer others and the product should be amazing enough to engender those referrals. But also gone is marketing as positioning – which is the real value of marketing.

Of course, it has worked. In the SMB and lower middle-market DTC eCommerce space, Shopify has most of the oxygen in the room. A typical Shopify agency doesn’t play in the Fortune 500 world of global system integrators needed for Enterprise adoption. While Shopify has always had a large accounts team, a new Enterprise focus for the firm demands a new approach.

Deals with retailers above $500 million incur long sales cycles, careful evaluation, security and IT audits, and mind-numbing negotiation with procurement – all things that Shopify thought it was better than only a few years ago when it was arming the rebels.

Last year, Bobby Morrison was brought in as Chief Revenue Officer to put in place a more Enterprise-focused culture, backed by a real professional services organization. Is it enough?

This observer can’t help but notice that there is no Enterprise marketing leader at Shopify to support Morrison’s efforts to fill the top of the funnel. This is likely something that will need to be remedied in 2023 if Shopify wants to set itself up for success in the future.

I’d like to see such a marketing leader responsible for the following things at Shopify:

Clearly own its positioning and messaging for the Enterprise offering, and it’s position within the overall Shopify Brand, and Plus. It’s not clear right now where Shopify Plus ends and Components begins. Is Components just a packaging exercise or is there something more there?

Create a steady stream of high-quality content for the Enterprise offering so that Shopify can learn what resonates in the market prior to the sales team getting into a deal situations.

Bring the needs of the market to the product teams so that the company is building the right product in the first place.

Without a clear marketing leader at the company, there are consequences. If a CMO is not hired within the next 12 months, it tells me that while Enterprise messaging is there, it will remain a hobby in terms of the overall business. But how many hobbies can the company afford to have?

Creators and Entrepreneurs

Shopify Plus: Salesforce, Magento refugee conversion

Payments and Financial Services

Enterprise retailers

B2B manufacturers and distributors

Advertising

Shop App

Fulfillment (RIP)

How Does the Company Continue to Position Shopify Plus Going Forward?

Shopify Plus is the crown jewel and growth engine of Shopify, but you wouldn’t know it from the company’s messaging.Just look at the company’s two recent efforts:

On one-hand, Shopify is still trying to be the “entrepreneurship” company. Look no further than the company’s PR strategy to recently release a Global Entrepreneurship Index.

On the other hand, Shopify is the checkout company. In Shopify’s recent release of its conversion statistics there isn’t even a single mention of Plus.

If anything, this observer feels that Shopify should continue sticking to the path that Loren Padelford originally set Shopify Plus on: moving up-market a little at a time. It should own two concepts: speed to market and total cost of ownership.

The more time passes, the more that most companies realize that if it can get to market faster and keep maintenance costs lower with Shopify, it should just do that. What’s the point of the headless hype if it achieves only the objectives of engineering (decoupling) and not the goals of the business (profitability)?

Seems like something worth asking as Shopify moves away from its roots and further up-market.

Will Shopify's Move Up-Market Dilute Its Small and Medium Business Focus?

The question of what the Shopify brand means is at the forefront because a brand needs to be relevant to a particular audience in order to be effective.

Shopify has been on quite a journey. Lest you forget, not two years ago Shopify was playing “Star Wars” music on its earnings call pre-roll, indicating its focus on arming its rebel entrepreneurs against Enterprises that don’t do eCommerce as well as Shopify. A year ago, Lutke claimed that the vertical integration of logistics was Shopify’s biggest opportunity.

Simply put, that tune has changed; 2022 was the last time the rebels were mentioned.

Ironically, one of the biggest risks to Shopify’s entrance in the Enterprise market is its own beloved brand. Yes, we are talking about the brand extension that Shopify has performed with its launch of Commerce Components by Shopify. In the past, particularly when Padelford was there, Shopify was always very careful to say that Shopify Plus was stretching up-market, not going up-market. This language ensured that Shopify was able to maintain its small business messaging, but slowly move into the tier above it.

That tune has also changed.

Suppose that Shopify’s Enterprise launch is successful: won’t entrepreneurs wonder if Shopify is truly committed to their needs going forward? There is a serious risk that an Enterprise-focused Shopify becomes too big and bulky for startups who need something fast and nimble. Just like Shopify used to be.

Yes, I’m talking about classic low-end disruption, and it must definitely be high on Shopify’s worry list.

Wrapping Up: Can Shopify Attach Itself to a Rocket Booster?

With the “reversion to the mean” of eCommerce growth, Shopify aggressively looking to expand its addressable market. Whether it works will depend on a few factors.

The growth case for Shopify is as follows:

Shopify will leverage its SMB dominance into both POS and Enterprise, given its excellence with eCommerce technology.

Shop Promise will accelerate GMV another 25% due to date-definite and speedy delivery, now provided by its partners at no capital expenditure risk to Shopify.

Shop App will find its footing and provide the consumer marketplace flywheel that Shopify needs to truly cement its place in eCommerce leadership for the long-term.

Shopify will keep experimenting in areas like advertising which will eventually add additional net operating margins to the business.

On the other hand, there is a Shopify doomsday scenario to be painted as well, including:

Shopify’s turn up-market makes the company take its eye off the ball in its core SMB market, leaving it vulnerable to low-end disruption.

Commerce Components by Shopify is not taken seriously by Enterprise brands due to Shopify’s brand history with SMBs.

Shopify Fulfillment shows management’s ability to be easily distracted by shiny objects. The company has never really come clean on how its decision making processes can improve, relying on game theory like side quests, while not taking the time to clarify why it ever considered it part of the main quest to begin with.

Shopify will let the Amazon fox in the hen house by partnering with Buy With Prime, ceding to Amazon’s biggest demands.

Shop App never develops far beyond its roots as a glorified shipment tracker for consumers.

While the answer is likely in-between one of these cases, it is definitely worth watching given the importance of Shopify in the eCommerce world.

Expert Consulting: How Will You Grow Your eCommerce Company?

Look no further. One of the reasons that I spend so much time writing about companies like Amazon and Shopify is that these are the two largest ecosystems in eCommerce. Every brand, investor, agency, and software company is affected by the moves these two companies make — either directly, or indirectly.

So, if you are in the eCommerce ecosystem somewhere and are looking to launch a new offering, wouldn’t it make sense to seek out advice from one of the deepest thinkers in the space?

For more on Shopify, you might also like: